What is the meaning of FinOps, and what does it stand for?

FinOps, a combination of Finance and DevOps (not to be confused with FinOps in finance, which stands for Financial Operations), is a cloud financial management practice that aims to bring teams together to ensure a company maximizes its cloud ROI (Return on Investment) for using Cloud Computing. It is a strategic approach combining systems, best practices, and culture to increase an organization’s ability to understand cloud costs and make informed decisions.

FinOps aims to balance flexibility, speed, and cost in cloud environments. It promotes cross-department collaboration among finance, engineering, business, executives, and other units, enabling the organization to adapt to changing needs and opportunities quickly.

In a FinOps model, IT, finance, and business teams work collectively to fully leverage the benefits of the cloud.

What Companies Use FinOps?

Any company that spends significant resources on cloud computing expenses and aims to manage these effectively and make the biggest return on their cloud investment can benefit from the application of FinOps. These companies are typically:

Tech-Heavy Industries: Companies in tech-focused industries, such as software development, IT services, data management, artificial intelligence, and more, frequently use FinOps. These businesses usually have substantial cloud expenses due to heavy reliance on digital platforms and services.

Large Enterprises: Large corporations across various sectors, including finance, healthcare, retail, and more, also use FinOps. These organizations often have complex cloud environments and large-scale operations, leading to substantial cloud costs that need to be optimized. Usually, these companies do not use a single cloud provider, and their cloud workloads are shared across many teams. This makes it harder to align on single business objectives and requires building cross-functional teams across the organization to help.

Startups and SMEs: Emerging companies and startups operating in the digital space can also utilize FinOps for effective cost management. However, it is worth noting that if their cloud costs are not too high, focusing on their business usually brings more value than optimizing their cloud usage.

Cloud-Dependent Organizations: Any organization that relies heavily on cloud services is a candidate for FinOps. This could include educational institutions, non-profit organizations, government agencies, etc.

While the above types of companies commonly use FinOps, the practice can benefit any organization seeking to improve financial visibility, control costs, and enhance the value derived from cloud investments.

What is the Need for FinOps?

FinOps has become increasingly crucial due to cloud services’ growing complexity and variable spending model. Without a proper framework, businesses risk spiraling cloud costs and inefficient use of cloud resources. FinOps addresses this by providing a structured approach to cloud financial management and cost optimization. Usually, companies start with limited public cloud spending. But as they go through cloud transformation (or migration) and onboard more applications to the cloud, they realize they have a lot of cloud waste and can make more efficient processes around their cloud operations. This is when they look at finops adoption.

There are several needs for incorporating FinOps into an organization’s strategies, including:

Cost Control: One of the significant challenges with cloud computing is its cost. FinOps brings cost visibility, optimization, and control to your organization, helping you accurately manage and forecast cloud expenses.

Enhanced Decision-Making: FinOps allows for improved decision-making involving cloud usage and costs by defining processes and structures and integrating them with technology. This allows for more efficient use of resources and better decision-making regarding finance and technology.

Improved Collaboration: The FinOps framework connects IT, finance, and business teams. This collaborative appropriation of roles and responsibilities leads to better financial governance, efficient usage, and a more value-oriented approach to utilizing cloud resources.

Accountability: With FinOps, each team knows how much they spend on cloud computing and why, bringing accountability into the organization. This fosters a culture where everyone takes responsibility for their cloud usage.

Scalability: FinOps is highly scalable, making it suitable for organizations of all sizes, from startups to multinational corporations. By utilizing FinOps, businesses can ensure that their cloud expenditure remains proportional to their growth.

Adopting a FinOps approach to managing your cloud spend can enable your organization to realize the financial and operational benefits of cloud computing fully. As cloud solutions become increasingly integral to business operations, having a solid FinOps strategy in place is becoming a necessity rather than an option.

What is the Goal of FinOps?

The primary goal of FinOps is to provide maximum business value by creating an equilibrium between speed, cost, and quality. It enables cross-functional teams to make trade-offs between these elements while ensuring effective financial control and cloud utilization.

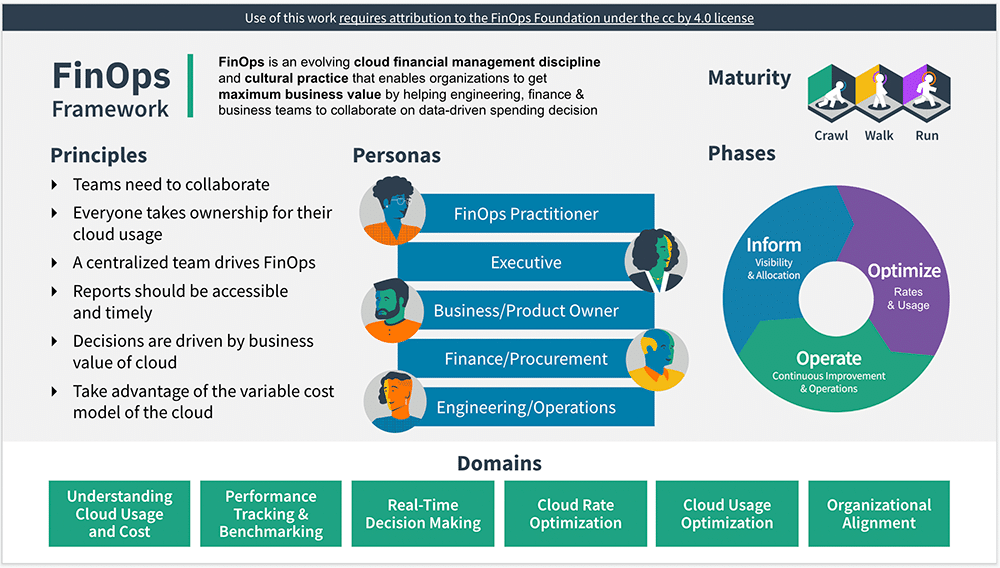

The FinOps foundation was created to help companies plan, set up, and run FinOps teams to enable them to achieve their goals. They created a FinOps Framework, separated the work into three phases, created a set of core principles, and assigned roles and responsibilities to different stockholders.

How FinOps Works: The Three Phases of FinOps

Inform Phase: The first phase involves collecting data about cloud spend and usage. This is crucial for visibility into how cloud resources are being utilized.

Optimize Phase: In this phase, the gathered data is analyzed to identify cost optimization opportunities, which can then be acted upon.

Operate Phase: Here, automated tools and policies are implemented to maintain optimal cloud spend and usage continually.

For more information about the three phases of FinOps and more, see FinOps: The Future of Cloud Cost Management.

Cloud FinOps Core Principles

There are six core FinOps principles.

- Teams need to collaborate

- Decisions are driven by the business value of the cloud

- Everyone takes ownership of their cloud usage

- FinOps data should be accessible and timely

- A centralized team drives FinOps

- Take advantage of the variable cost model of the cloud

Who are the Key FinOps Stakeholders?

There are eight Cloud FinOps personas as defined by the FinOps foundation:

1. FinOps Practitioner: FinOps practitioners are crucial in connecting business, IT, and finance teams. They facilitate evidence-based decision-making in near-real time to optimize cloud usage and enhance business value. Their primary focus is establishing a FinOps culture and empowering stakeholder teams by showcasing a solid understanding of the principles and capabilities outlined in the FinOps Framework, providing a set of recommended actions and best practices. They help control cloud spending and increase cost efficiency.

2. Executives: Executives, such as a Vice President or Head of Infrastructure, Head of Cloud Center of Excellence (CCoE), Chief Technology Officer (CTO), or Chief Information Officer (CIO), focus on driving accountability and building transparency. They ensure that teams are efficient and do not exceed budgets.

3. Business/Product Owner: These participants are usually Business and Product Owner team members, such as a Director of Cloud Optimization, Cloud Analyst, or Business Operations Manager.

4. Engineering and Operations: Engineers and Ops team members, including Lead Software Engineers, Principal Systems Engineers, Cloud Architects, Service Delivery Managers, Engineering Managers, and Directors of Platform Engineering, have the primary responsibility of building and supporting services for the organization. Cost is treated as a metric, just like other performance metrics, and is tracked and monitored accordingly. These teams have the biggest impact on cloud costs and focus on architecting the systems, developing and delivering the features required as set by Product Management, optimizing resource usage through activities such as rightsizing (resizing cloud resources to match workload requirements), identifying unused storage and compute resources, and addressing spending anomalies. Empowering engineering teams is one of the key ways to implement FinOps and achieve cloud cost optimization.

5. Finance: Finance members, such as Financial Planners, Financial Analysts, and Financial Business Managers and Advisors, rely on the reports generated by the FinOps team for cost allocation, showback allocation, and forecasting. They collaborate closely with FinOps practitioners to analyze historical billing data and develop accurate forecasting models for planning and budgeting purposes.

6. Procurement: Procurement analysts, sourcing analysts, vendor management, or directors within procurement teams rely on insights from the FinOps team to identify sourcing and purchasing opportunities for products and services from cloud platform vendors. Procurement must collaborate closely with FinOps to ensure that the prices and terms negotiated in the contract are met and to streamline the procurement process. Additionally, procurement may have a legal component that involves reviewing contract language.

7. ITAM Leader / Practitioner (newly added in 2023): ITAM team members, such as the IT Asset Manager, Software Asset Manager, IT Asset Analyst, IT Asset Administrator, IT Asset Specialist, IT Asset Compliance Manager, and IT Asset Procurement Specialist, have the primary goal of maximizing the business value of all assets within the organization. They are also responsible for managing asset optimization and contract compliance risks. Collaborating closely with other IT professionals, including those in Architecture, Engineering, and Security, and stakeholders, they develop and implement effective IT asset management strategies that align with the organization’s goals and objectives.

8. Sustainability Practitioner within IT (newly added in 2023): The Sustainability Practitioner in Enterprise IT integrates green initiatives and principles into the organization’s IT operations. They develop strategies for energy-efficient and resource usage-efficient practices, reduce emissions from IT infrastructure, and promote a culture of sustainable decision-making in procurement and operations. By balancing the demand for IT services and environmental goals, they use their expertise to lower costs, mitigate risks, and establish predictability in resource usage.

Benefits of FinOps

- Cost Optimization: Achieves maximum business value with optimized cloud spending.

- Visibility: Provides a detailed view of cloud costs and resource utilization.

- Shared Responsibility: Promotes a culture where everyone is accountable for cloud spend.

- Agility: Enables quick adjustments to cloud financial processes as needs evolve.

- Data-Driven Decisions: Facilitates decisions based on quantifiable metrics and data.

How to Automate FinOps?

Automating FinOps can significantly simplify the management of cloud resources and finances. Here are steps an organization can take towards Cloud FinOps automation:

Use Cloud Management Tools: The FinOps foundation enables companies who provide cloud management tools to join their members area (via a paid membership). These platforms provide comprehensive visibility into cloud usage and expenses, estimate the cost of code changes pre-deploy, set up alerts to oversee spending, and optimize cloud costs. Cloud providers such as AWS, Azure, and Google Cloud have native tools, which are the best place to start.

Set Up Automated Alerts: Automating alerts when costs exceed pre-defined thresholds allows businesses to manage their cloud budget and catch surprises on the bill.

Automate Reporting: Develop custom reports with the tools of your choice to ensure all decision-makers have the information they need. Automate the generation and distribution of these reports for efficiency.

Automate Forecasting and Estimation: Use tools like Infracost to show your engineering teams how their code changes will impact costs before launching resources. This will help Cloud FinOps teams see what their expected costs will be and help with future forecasting.

Implement Idle Resource Automation: Tools can identify when resources are idle and either shut them down or repurpose them, preventing unnecessary expenditure. This usually involves looking at cloud services and utilization over time to understand usage.

Utilize Auto Scaling: Auto-scaling enables organizations to automate the adjustment of resources based on load or schedule, which results in optimal utilization and cost savings. All cloud providers now offer auto-scaling features.

Automate Governance: Implement policy as code for resources to ensure consistency and audibility of compliance with financial controls. Tools like Infracost have a pre-defined list of best practice FinOps Policy Packs from Well Architected Frameworks and the FinOps foundation.

Continuous Optimization: Continuously optimize resource utilization with real-time data analysis and automation.

FinOps bridges financial management and cloud resource utilization, enabling organizations to extract the most value from their cloud investments. It’s not just a set of best practices but a cultural change that promotes shared responsibility and collaboration across various facets of a business.

Frequently Asked Questions (FAQs)

What Are the Main Benefits of FinOps?

The core benefits of FinOps include cost optimization, increased visibility into cloud spending, and fostering a culture of shared financial responsibility.

How Does FinOps Achieve Cost Optimization?

FinOps employs various methods, such as data-driven analytics, automation, and collaboration between finance, technology, and business teams to achieve optimal cloud cost management.

Is FinOps Suitable for All Types of Organizations?

FinOps is highly adaptable and can benefit organizations of all sizes, from startups to enterprise-scale businesses. The more complex and higher the cloud bill, the more FinOps can help.

What Role Do Cross-Functional Teams Play in FinOps?

Cross-functional teams bring together individuals from finance, technology, and business to make more informed cloud spending decisions, thereby maximizing business value.

What Are the Three Phases of FinOps?

The FinOps journey often involves three phases: Inform, Optimize, and Operate. Each phase has its own set of practices and objectives to enhance cloud financial management.

How Does Cloud FinOps Differ from Traditional Cloud Cost Management?

Cloud FinOps integrates more closely with business operations to deliver real-time insights into cloud spending, making it more dynamic than traditional cloud cost management methods.

How Do I Start My Cloud FinOps Journey?

The first step usually involves creating visibility into your current cloud spending and assembling a dedicated FinOps team to manage and optimize cloud spending.

How Important Is Automation in FinOps?

Automation is crucial for real-time data analytics and is critical to timely and effective cloud spending decisions.

Does FinOps Require Specialized Tools?

While specialized FinOps tools are available, the methodology can often be implemented using your existing cloud financial management and analytics tools.

Is FinOps about how to save money?

Although one of the biggest KPIs FinOps teams are measured against is to save money, many more tasks must be done. Cloud moves ownership to end users, and it is important to help the engineering teams (the buyers) make informed decisions and optimize cloud resources.

What Is the FinOps Foundation?

The FinOps Foundation is an industry group that promotes FinOps principles and practices, offering resources like the FinOps Framework, case studies, and best practices for organizations.