FinOps: The Future of Cloud Cost Management

Get More Cloud for Your Money with FinOps

Most organizations grapple with escalating cloud costs as they rapidly scale their operations. Once touted for cost-efficiency, the cloud is a significant line item in the budget. Enter Cloud FinOps: an operational model that combines technology, business, and finance professionals to manage and optimize cloud spend. At its core, FinOps is about extracting maximum business value from every cloud dollar spent. It blends the expertise of financial processes with the agility and responsiveness that cloud services offer and brings in all stakeholders to be kept accountable. If you’ve been working in the cloud for many years, you might remember the first version of FinOps being called Cloud Financial Management.

Benefits to Opt for FinOps?

- Transparency: FinOps allows for clear visibility into both cloud spend and cloud usage to all parts of the organization, from engineers to engineering management, finance, procurement, and the executive teams.

- Business Alignment: It aligns cloud spending with business strategies. This includes training teams, calculating and bringing unit economics to the organization, defining and increasing maturity, and applying the principles.

- Optimized Costs: Achieve effective cloud cost optimization by continuously monitoring and adjusting your cloud operations. It comes down to saving money and increasing cloud utilization.

How FinOps Works: The Framework

The FinOps Foundation encourages companies to drive FinOps adoption using the FinOps Framework, which provides an operating model. These include six topics:

FinOps Domains: These are the tasks that FinOps teams should perform in their practice. They include tasks such as understanding cloud usage and cost, performance tracking and benchmarking, real-time decision-making, cloud usage optimization, cloud rate optimization, and organizational alignment.

FinOps Capabilities: These are the functional areas of activity that require the implementation of processes. They include cost allocation, forecasting, budget management, resource utilization and efficiency, workload automation, teaching the FinOps culture, etc.

FinOps Maturity Model: Given the ongoing efforts required by companies to mature their practice and their FinOps practitioners, tasks are split into three phases: The crawl, walk, and run phases, each adding further, more complicated tasks.

FinOps Personas: This defines who should be in that centralized team and what roles they must fill. These include FinOps practitioners, executives, business and product owners, engineering, financial management teams, and procurement.

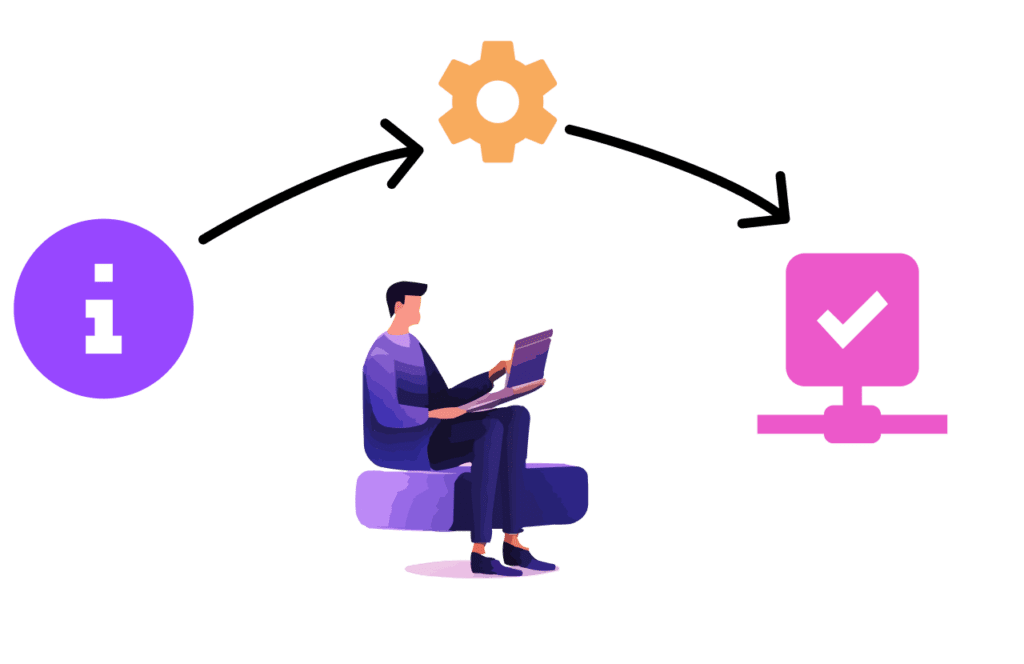

FinOps Phases: Projects can be in three iterative phases. Each project, business unit, or application team might be in a different step, from informing, optimizing, and operating.

FinOps Core Principles: Finally, the principles guide how to improve FinOps. These include the requirement for teams to collaborate, decisions driven by the cloud’s business value, everyone taking ownership of their usage, data being made available promptly, a centralized team driving FinOps, etc.

The Three FinOps Phases

Phase 1: Inform

Transparency is the cornerstone here. You can’t control what you can’t see or measure. Your organization needs to implement cloud costs directly in workflows and add robust dashboards that display real-time data on cloud costs and usage. Tools that help empower engineering teams, such as Infracost, and tools that help set up cost allocation tags can further enhance this phase.

Phase 2: Optimize

Data has been gathered; now it’s time for action. Engineers can now see the cost impact of their technical decisions directly in their workflow, which helps optimize cloud usage by implementing best practices. Next, identify mismanaged resources and unused cloud instances. Savings can be up to 40% just by terminating these resources. Rightsizing and Reserved Instances are two additional strategies to optimize cloud costs. Save money and gain cloud efficiency by applying these across public clouds such as Amazon Web Services, Google Cloud, and Microsoft Azure.

Phase 3: Operate

The culmination of FinOps is about making this practice a part of your organization’s culture. Regular meetings involving cross-functional teams can ensure everyone is on the same page. Furthermore, setting budgets and monitoring public cloud spending and cost anomalies should be ongoing.

The FinOps Principles

What makes FinOps tick? Well, several principles guide the FinOps Framework:

- Teams Need to Collaborate: Different teams must collaborate to achieve the desired outcome. Finance, technology, product, and business teams work together in real time.

- Decisions Driven by Business Value: When making decisions, the tradeoff is always between cost, quality, and speed. Making this a conscious decision rather than a hidden motive. Cloud drives innovation, and the FinOps team can help with the tradeoffs. The aim is to use best practices to maximize business value.

- Taking Ownership of Usage: The cloud moves ownership, and this principle holds people accountable for their cloud usage supported by the wider team. The FinOps team should be cross-functional.

- Data Should be Accessible and Timely: Traditional IT works on fixed budgets, but the cloud operates on a variable cost model. This requires processing and sharing the data as soon as it is available. Fast feedback loops, especially before the deployment of infrastructure, are critical.

- Centralized FinOps Team: FinOps starts centralized, but the goal is to make it a part of the organization’s fabric. Enabling distributed teams to take ownership of their cloud usage and spend is vital to FinOps’ success.

- Take Advantage of the Variable Cost Model: The variable cost model of the cloud is an opportunity to deliver more value and save money. Embracing this creates agile teams, but adapting can be challenging and will take time.

The FinOps Personas

- Engineering Teams: These folks directly or indirectly generate cloud costs. They’re responsible for implementing optimizations as they hold the keys to optimizing cloud resources. The Cloud Center of Excellence (CCoE) is usually part of the engineering teams.

- Finance Teams: They are responsible for budgets and ensuring the organization is financially sound.

- Product Owners: Product managers and owners usually request new features or capabilities requiring infrastructure.

- Executives: VPs or Head of Infrastructure, Head of the Cloud Center of Excellence (CCoE), who will ultimately support or block significant efforts and decide the cloud investment.

- FinOps Practitioners: This could be a centralized team that becomes more distributed as your FinOps practice matures.

- Procurement: Cloud analysts, vendor managers, and others responsible for working with the cloud providers to reduce cloud spending via negotiations and legal reviews.

What Role Can Automation Play in FinOps?

In the fast-paced world of cloud computing, manual monitoring and adjustments won’t cut it. Automation can be a game-changer. Imagine setting up automated scripts that shut down unused resources or send alerts for potential budget overflows. Automation tools can also automatically integrate with your CI/CD pipelines to enforce cost controls and cloud tags. In a variable spend model where costs fluctuate wildly, automation helps keep things in check, ensuring cost efficiency.

FinOps is Not a One-Time Project But a Cultural Shift

As organizations continue their cloud migration journeys, robust cloud financial management practices become imperative. By focusing on FinOps principles and practices, businesses can turn a potential financial pitfall into a competitive advantage. This isn’t merely about cost-cutting; it’s a strategic approach to cloud spending that aligns with business objectives, maximizes return on investment, and fosters a culture of financial accountability.

So, if you’re looking to manage your cloud costs effectively, embark on your FinOps journey today. It’s not just the smart thing to do; it’s the financially responsible thing.

Frequently Asked Questions (FAQs)

What Is FinOps?

Cloud FinOps is a cloud cost financial management practice that combines finance, technology, and business teams to enable more effective cloud spending decisions. It brings cost visibility, business alignment, and optimization to control cloud spend.

How Does FinOps Differ from Traditional Cloud Financial Management?

FinOps goes beyond tracking and monitoring to incorporate cross-functional teams, enabling organizations to make data-driven spending decisions for cloud resources and implement best practices.

What is the Core Objective of FinOps?

The main goal of FinOps is to align cloud usage with business initiatives, thereby gaining maximum business value from your cloud investments.

Is FinOps Only Relevant for Public Cloud Users?

No, the principles of FinOps can be applied to both public and private cloud environments, although the public cloud variable spend model makes FinOps particularly useful.

What Are the Key FinOps Principles?

FinOps principles include:

- Team collaboration and everyone taking ownership over their spending.

- Decisions are driven by data that is accessible, timely, and aligned with the business value of the cloud via a centralized team.

- Taking advantage of the variable cost model of the cloud.

What Types of Companies Benefit Most from FinOps?

Any organization that uses cloud computing resources and aims to align cloud spending with business value can benefit from FinOps and could implement FinOps.

Can FinOps Be Implemented in Stages?

Yes, the FinOps journey has three phases, from crawl to walk to run, and is iterative, generally consisting of three key iterations: Inform, Optimize, and Operate, allowing for phased implementation.

What Role Do Automation and Reporting Play in FinOps?

Automated reporting tools are crucial for real-time visibility into cloud costs, enabling quick decision-making and more effective cost optimization strategies. Automating tools in CI/CD pipelines will help proactive cloud cost optimization and enforce best practices.

How Can FinOps Help in Cost Optimization?

By promoting shared responsibility for cloud financial management across different departments, FinOps enables organizations to maximize the value they get from their cloud spending. From choosing a cloud provider for specific workloads to realizing cost savings, the FinOps team, built from cross-functional teams, can help reduce cloud spend.

Who Are the Key Stakeholders in a FinOps Initiative?

Key FinOps stakeholders include finance, technology, and business teams, all of whom play a role in making data-driven spending decisions for cloud services. More information can be found on the FinOps Foundation website.